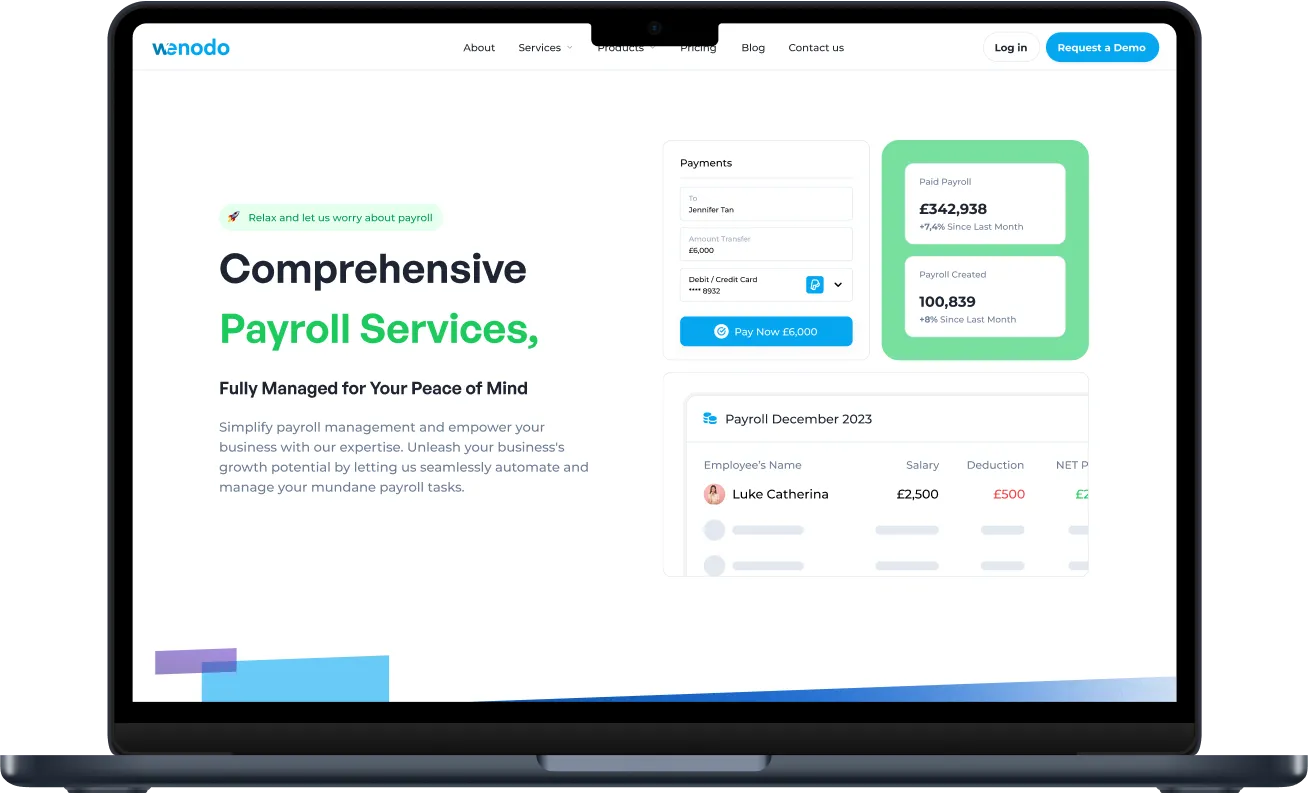

Comprehensive Payroll Services,

Fully Managed for Your Peace of Mind

Simplify payroll management and empower your business with our expertise. Unleash your business's growth potential by letting us seamlessly automate and manage your mundane payroll tasks.

Workforce to Operations

Why Us

Experience Combined with Simplicity

S

Skilled

Combined experience of 60+ years in hospitality, accounting, operations and tech

I

Insight Driven

Real time insight of your business assisted by our multi-faceted expertise

M

Modern Thought

Modern thought process to solving business challenges with the help of technology

P

Personalized

Personalized approach treating your business as our own and working towards success

L

Lower Cost

Save cost at every step with access to vast partner network and utilising existing ecosystem where possible

E

End-to-end Solution

End-to-end digital solution with a commitment to give excellent user experience

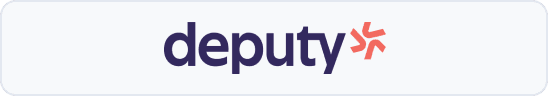

Perfect payroll, every time

Our integrated and flexible solutions make it simple to pay employee’s accurately and on time, every time - for even the most complex workforces. You can count on world-class expertise to accurately and compliantly pay your team members everywhere.

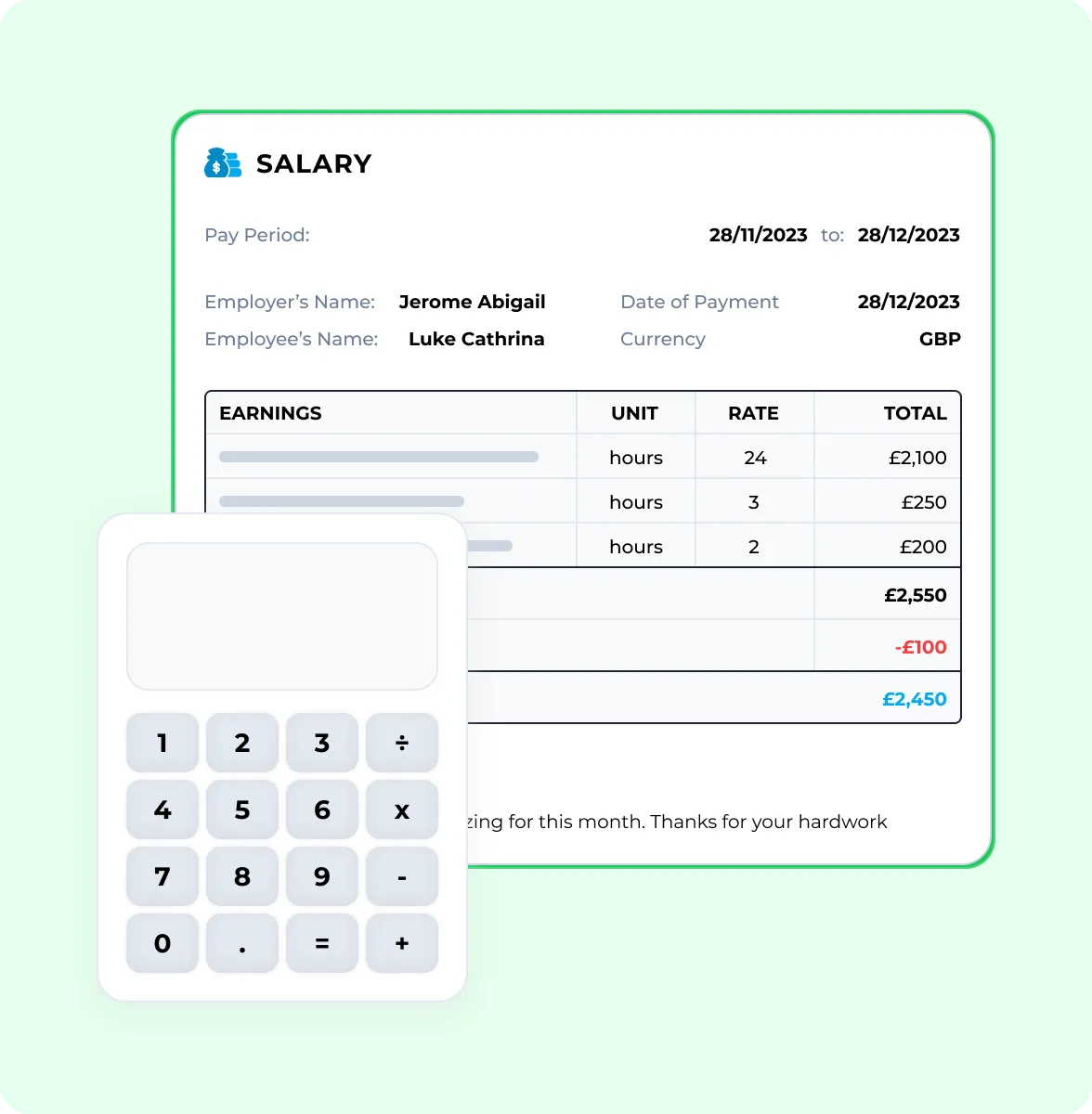

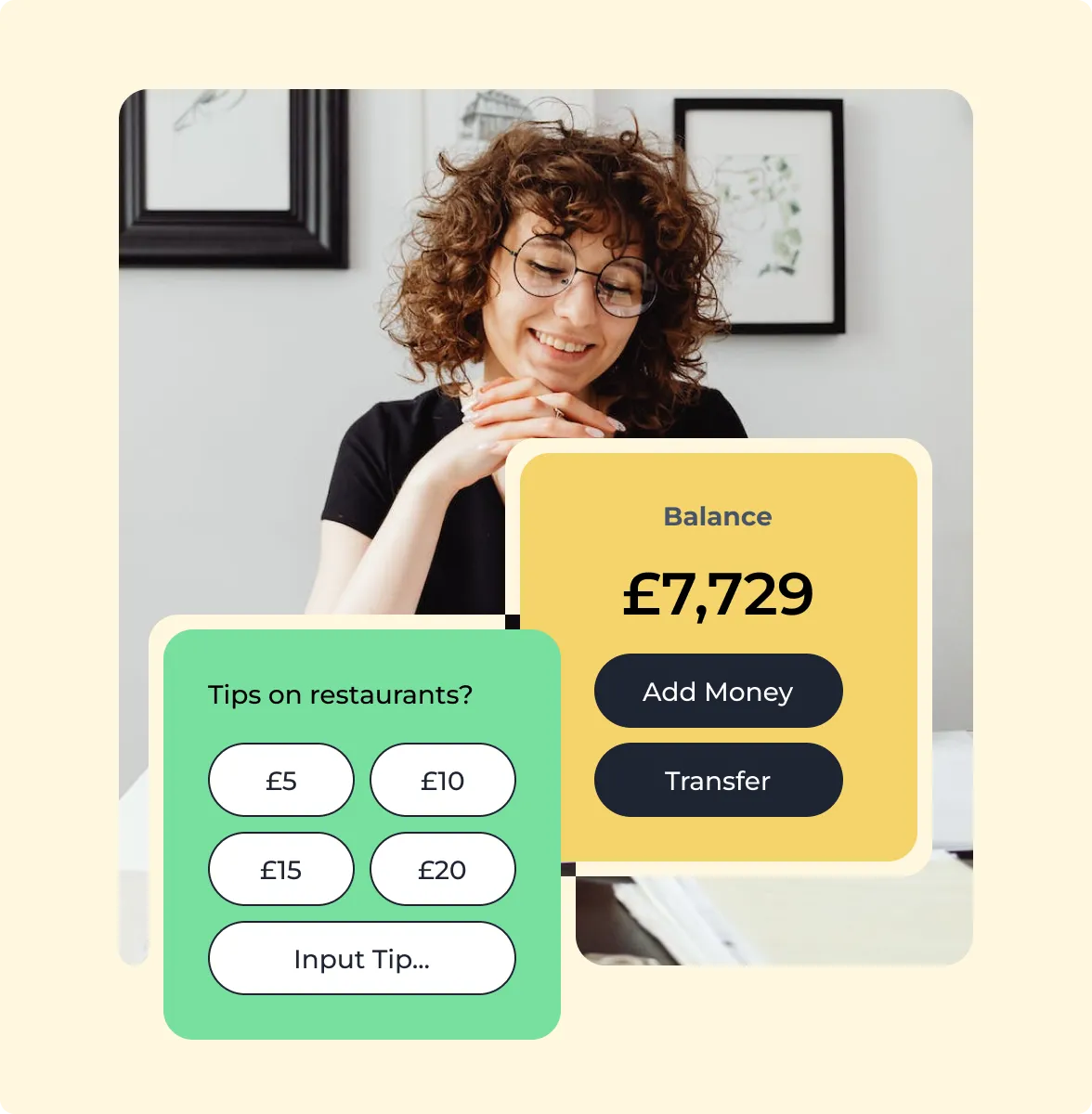

Make payments in seconds, not days

Unlike conventional BACS, our Faster Payments system allows for 24 x 7 x 365 wage transfers. We take complete control of your payment schedules and process payroll whenever it suits you.

Hassle-free Tronc Management

We ensure a smooth and trouble-free process of fairly allocating tips or service charges for staff, simplifying financial workflows and providing a stress-free experience for both employers and employees.

App Integrations for Supercharged Productivity

Unleash the Potential of Integrated App Solutions. Elevate Your Hospitality & F&B Operations with Effortless Sync and Unmatched Productivity

Accelerate Growth

Empower your team, optimize operations and secure a thriving future with our proven products and managed service offerings.

Wenodo Helps Hospitality Businesses

Discover a world of transformative benefits when you choose Wenodo as your hospitality and F&B management solution. Embrace efficiency and growth as you optimize

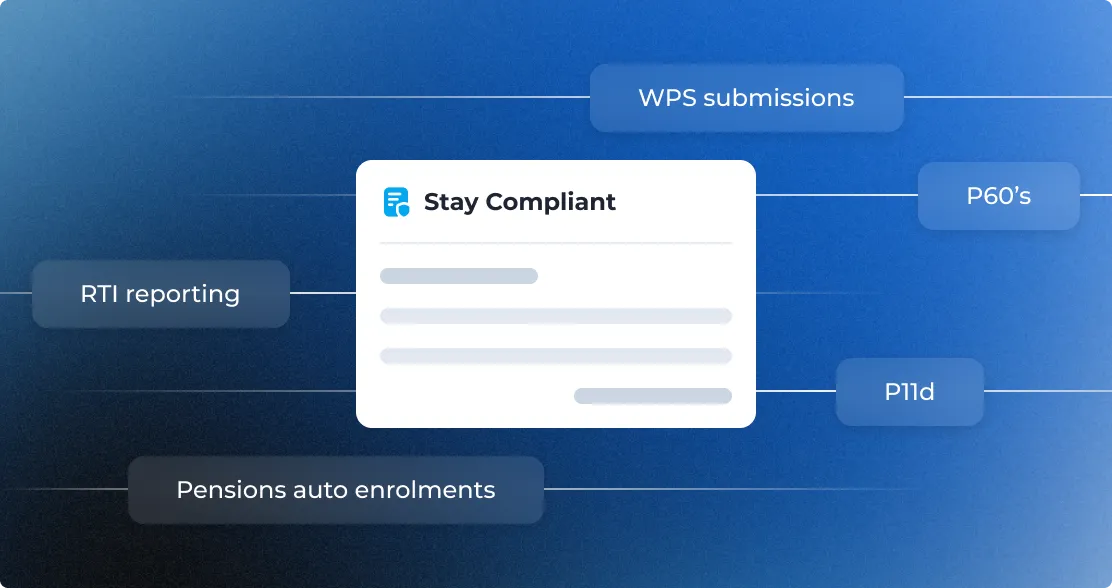

Stay compliant everywhere

Ensuring watertight compliance is crucial, and at Wenodo, we possess the expertise to stay ahead of legislation. Our commitment is to navigate the regulatory landscape seamlessly, providing you with confidence in compliance matters. We ensure all your compliances related to Pensions auto enrolment, RTI reporting, P11d, P60’s or WPS submissions are submitted accurately and on time.

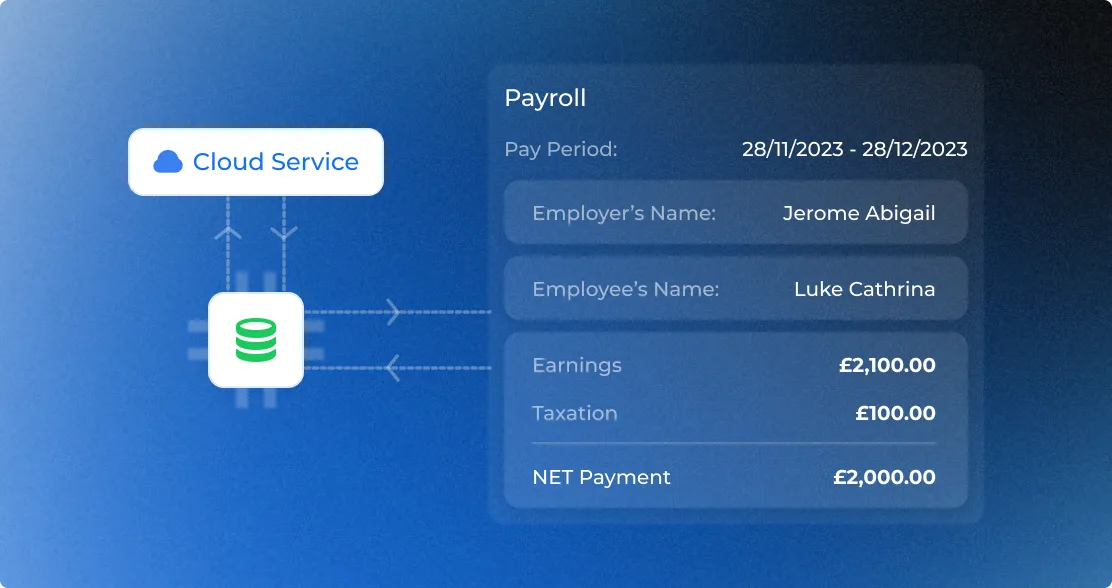

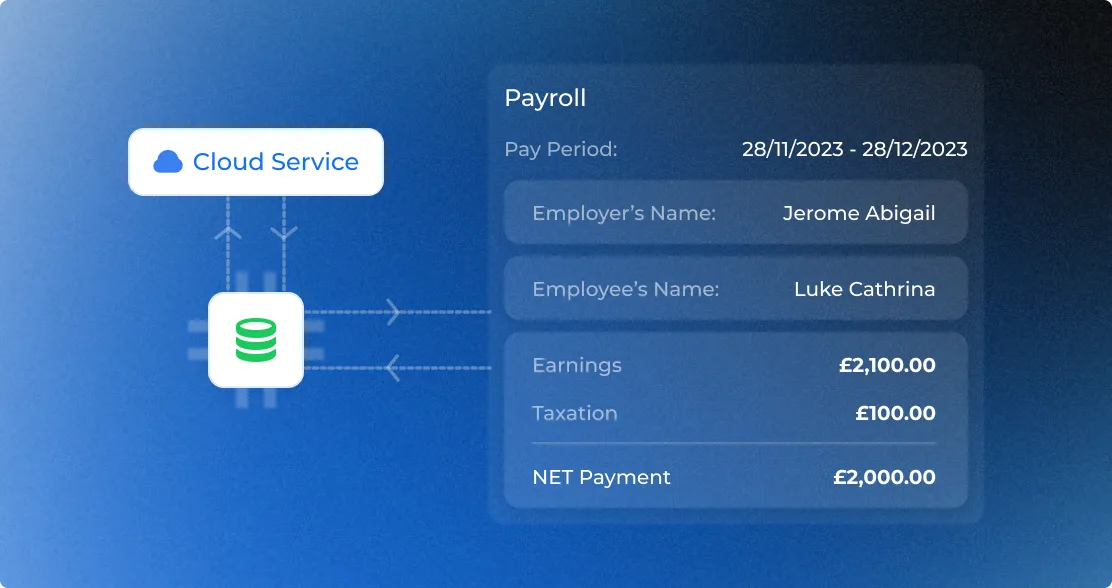

Integrated payroll processing

Eliminate redundant data and unnecessary overhead. Streamline your payroll processes with the Wenodo platform, simplify your management tasks into one cohesive relationship, and reclaim time to focus on expanding your team.

Full-fledged cloud-based payroll software

Our Payroll solution is comprehensive, robust, and fully developed, offering a complete set of features and capabilities for handling payroll tasks

Full-fledged cloud-based payroll software

Our Payroll solution is comprehensive, robust, and fully developed, offering a complete set of features and capabilities for handling payroll tasks

Integrated payroll processing

Eliminate redundant data and unnecessary overhead. Streamline your payroll processes with the Wenodo platform, simplify your management tasks into one cohesive relationship, and reclaim time to focus on expanding your team.

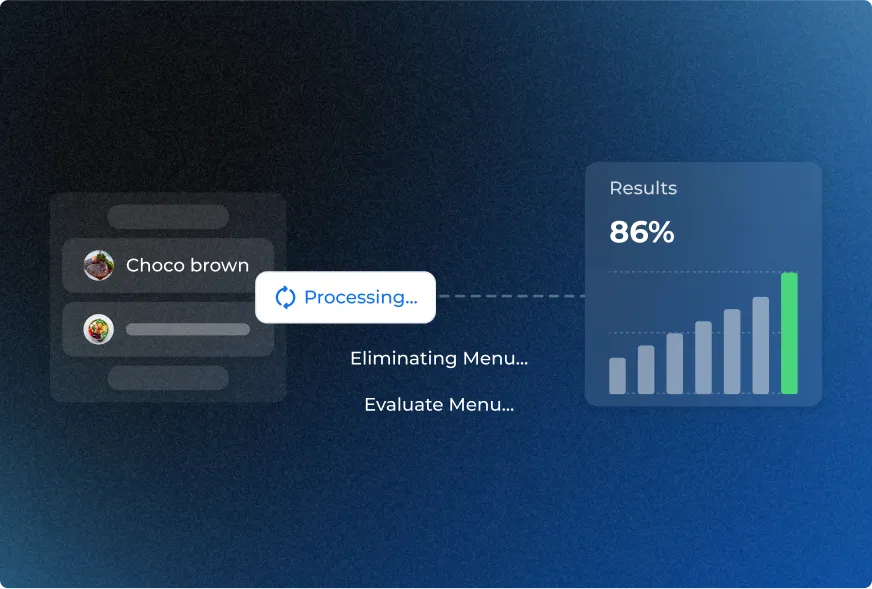

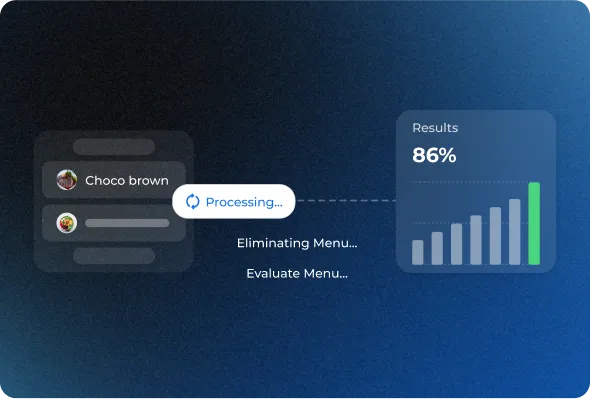

Comprehensive Payroll Reporting

We regularly evaluate your menu to identify the most and least profitable items. Streamlining the menu by focusing on high-margin dishes and eliminating those that contribute less to overall profitability. This not only reduces food costs but also enhances operational efficiency.

Questions They Have

Explore how Wenodo, a powerful hospitality and F&B solution, seamlessly.

Didn’t found answer?

Contact us!1

What is a managed payroll service?

A managed payroll service is a type of outsourcing that involves handing over all or part of your payroll processing to a third-party provider. This can be a great option for businesses of all sizes, as it can save time, money, and resources.

At Wenodo we offer a fully managed payroll service, which allows clients to continue running their operation, whilst outsourcing the majority of the associated time consuming activities related to payroll processing and post payroll submissions. Businesses can benefit from the latest technology and the expertise of our payroll professionals.

2

What does a managed payroll service include

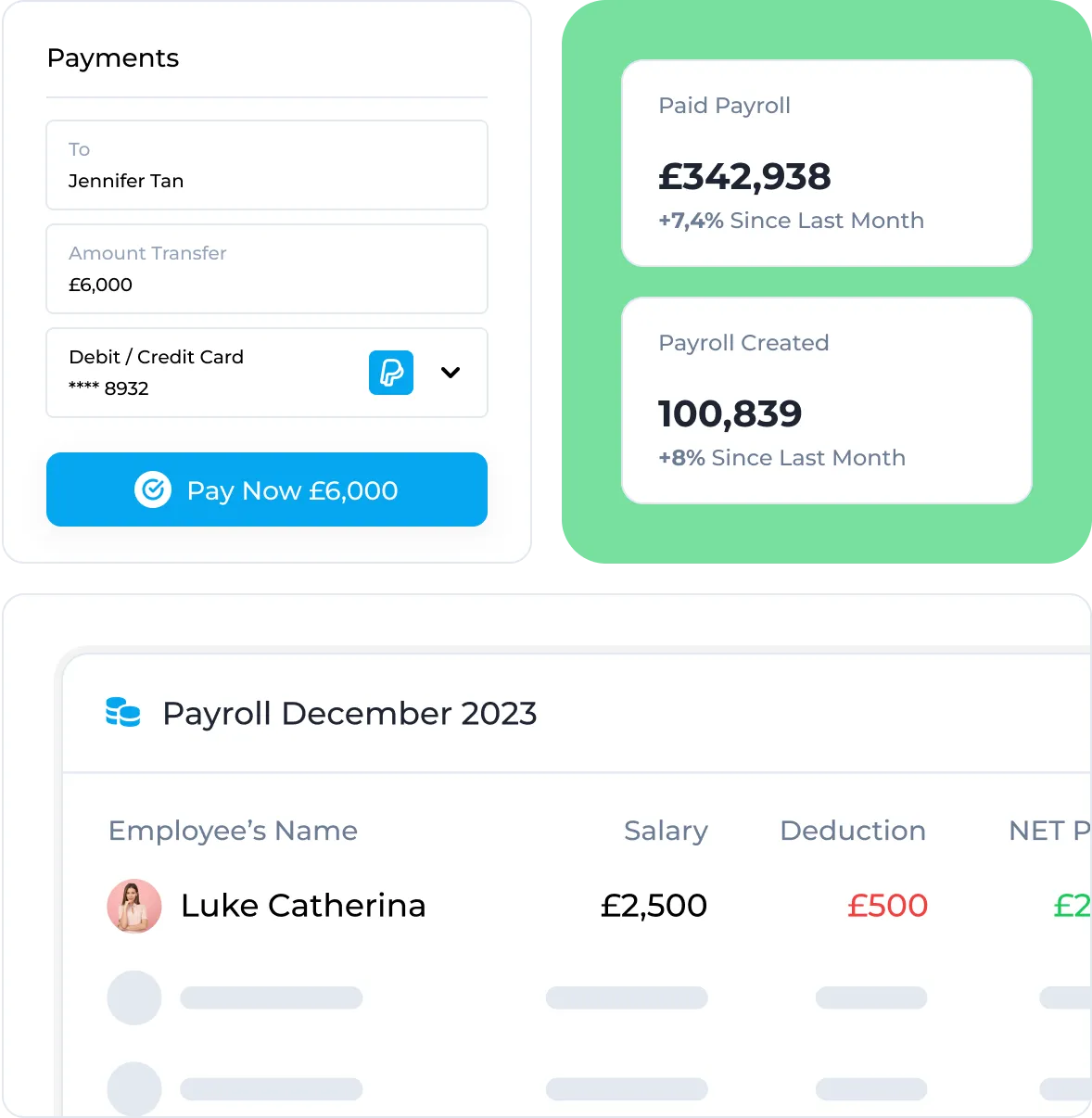

a. Salary Calculation:

Accurate calculation of employee salaries, including deductions for taxes, National Insurance contributions, pensions, and other statutory and voluntary deductions. b. Payslip Generation:

Preparation and distribution of digital or printed payslips for each employee detailing their earnings, deductions, and net pay. c. Tax Compliance:

Ensuring compliance with UK tax regulations, including the accurate calculation and submission of income tax and National Insurance contributions to HM Revenue & Customs (HMRC). d. Statutory Deductions and Contributions:

Handling statutory deductions, such as student loan repayments, as well as managing contributions to pension schemes in compliance with auto-enrollment regulations. e. Real-Time Information (RTI) Reporting:

Submission of Real-Time Information reports to HMRC, providing details on employee earnings, taxes, and other relevant information on or before each payroll run. f. Year-End Processing:

Completion of year-end processes, including the production and distribution of annual P60 forms for employees and submission of necessary reports to HMRC. g. Auto-Enrollment Pension Administration:

Management of pension contributions and compliance with auto-enrollment requirements, including assessment of employee eligibility and communication with pension providers. h. Data Security and GDPR Compliance:

Ensuring the security and confidentiality of payroll data, as well as compliance with the General Data Protection Regulation (GDPR). i. Employee Self-Service (ESS):

Provision of online portals or systems allowing employees to access their payslips, update personal information, and view relevant payroll-related documents. j. Dedicated Support:

Offering support services to address queries from both employers and employees regarding payroll-related matters. k. Legislative Updates:

Staying abreast of changes in payroll legislation and adjusting processes accordingly to ensure ongoing compliance. l. Customized Reporting:

Providing customized reports to meet the specific needs of the organization, allowing for detailed analysis of payroll data. Outsourcing payroll to wenodo’s managed service team can relieve businesses of the administrative burden associated with payroll processing, ensure compliance with legal requirements, and allow organizations to focus on their core activities.

3

What are the benefits of using Managed payroll services?

Using wenodo’s managed payroll services can offer several benefits for businesses. Here are some of the key advantages:

a. Compliance with Legislation: Keeping up with the constantly changing payroll legislation can be challenging. Managed payroll services are dedicated to staying compliant with the latest regulations, ensuring accurate tax calculations and timely submissions to HM Revenue & Customs (HMRC). b. Time and Resource Savings: Outsourcing payroll functions to a managed service provider frees up valuable time for your internal teams. This allows your HR and finance staff to focus on more strategic tasks, contributing to the overall efficiency of your business. c. Reduced Risk of Errors: Payroll errors can lead to financial and legal consequences. Managed payroll services often use advanced software that minimizes the risk of mistakes in calculations, tax filings, and other payroll-related processes. d. Cost Efficiency: Managing an in-house payroll department comes with various costs, including salaries, training, and technology infrastructure. Outsourcing payroll can be more cost-effective, especially for small and medium-sized enterprises. e. Scalability: As your business grows or changes, managed payroll services can easily scale their services to accommodate fluctuations in the number of employees. This scalability is particularly beneficial for businesses with varying workforce sizes. f. Security and Data Protection: Reputable payroll service providers implement robust security measures to protect sensitive employee data. This includes encryption, secure data storage, and adherence to data protection regulations, such as GDPR. g. Expertise and Support: Managed payroll services often have teams of experts who specialize in payroll processing and compliance. This expertise can be invaluable for navigating complex tax regulations and resolving any payroll-related issues that may arise. h. Employee Self-Service Portals: Many managed payroll services offer employee self-service portals. These portals empower employees to access their payslips, tax information, and other relevant details, reducing the administrative burden on HR. i. Focus on Core Business Functions: Outsourcing non-core functions, such as payroll, allows your business to concentrate on its core competencies. This can contribute to improved overall performance and growth. j. Real-Time Reporting and Analytics: Some managed payroll services provide real-time reporting and analytics tools. This allows businesses to access up-to-date information for decision-making and strategic planning. k. Adaptability to Changes: Managed payroll services can adapt quickly to changes in tax laws or regulations, ensuring that your business remains compliant and avoids potential penalties.

4

What is the process of moving over to Wenodo's Managed Payroll Service?

Whether you currently have an in-house function or are using a third party supplier, our first step is always to assess your requirements and understand what your organisation really needs from a payroll service. We take into account all the different elements that go to make up an employee’s pay (e.g. basic wage, overtime, bonuses, commissions, GAYE or other schemes, payment of expenses and so on).

If you are already using a third party supplier, we take special care to ensure that any issues that existed with the previous supplier are addressed and corrected as part of the requirements capture process.

We then build a system based on these requirements, which is populated then with base HR/Payroll/YTD data. The new system is then run in parallel with your existing system to test it is correct and to iron out any anomalies.

Once you are happy that the new system is producing correct figures we switch over to the new system. If you are currently using an external payroll provider, a changeover point will need to be agreed and we will provide communication and support to help manage this process.

5

How Can I be sure my payroll Data is secure?

At Wenodo, we prioritise client data protection by investing in the latest technology and highly advanced data security procedures to ensure your sensitive information is safe. Most significantly, we do not move any client data off shore and all data centres and servers that hold any payroll data are all located in the UK.

Empower Your Team, Drive Growth

Empower your team, streamline operations, and guarantee a prosperous future with our cutting-edge digital tools and intelligent accounting.